Uploading Credit Report to Department of Labor Maryland

Executive Summary

Over the last ten years, a growing number of cities and states passed laws limiting the apply of credit checks in hiring, promotion, and firing. Lawmakers are motivated by a number of well-founded concerns: although credit history is not relevant to employment, employment credit checks create barriers to opportunity and upward mobility, can exacerbate racial bigotry, and tin can lead to invasions of privacy. This report examines the effectiveness of the employment credit bank check laws enacted so far and finds that unjustified exemptions included in the laws, a failure to pursue enforcement, and a lack of public outreach have prevented these important employment protections from being every bit effective as they could exist.

- 11 states have passed laws limiting the use of employment credit checks. State laws to limit employer credit checks were enacted in California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington. Cities, including New York City and Chicago, have restricted credit checks also.

- Credit check laws are effective at increasing employment amongst task applicants with poor credit. A new report from researchers at Harvard and the Federal Reserve Depository financial institution finds that state laws banning credit checks successfully increase overall employment in low-credit census tracts past between 2.3 and three.3 per centum.

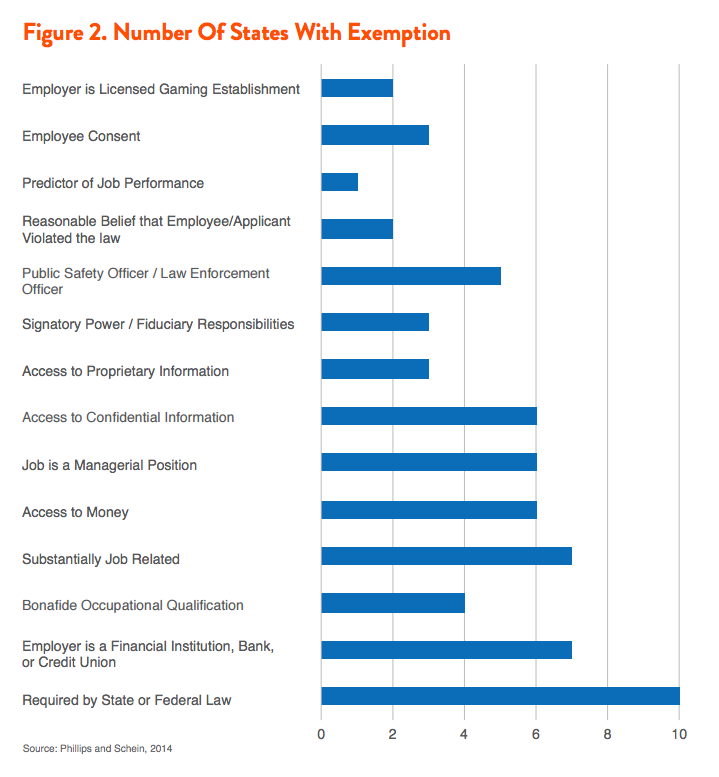

- Despite important goals of reducing barriers to employment and eliminating a source of discrimination, existing state laws on credit checks are undermined by the significant exemptions they contain. Although exemptions are not justified by peer-reviewed research, many state credit cheque laws include broad exemptions for employees handling cash or goods, for employees with access to financial information, for direction positions, and for law enforcement positions. Some legislators too limited concern that the number of exemptions that were ultimately included in the laws make them more hard to enforce.

- Demos research establish no successful legal actions or enforcement taken under the laws, even those that have existed for a number of years. While the beingness of the laws themselves may deter the use of employment credit checks, information technology is unlikely that every employer is in full compliance with the laws. Instead, the lack of any enforcement action confronting employers violating the laws suggests that credit check restrictions are not every bit effective as they could be.

- A lack of public sensation on the right to be employed without a credit cheque may undercut effectiveness. A key reason that states have non taken enforcement action is because they receive very few complaints most violations of the law. Demos finds that public education and outreach efforts virtually the credit check laws accept been minimal in many states, suggesting that few people are enlightened of their rights.

- New York City's new law restricting the use of employment credit checks is an improvement on past laws. In 2015, New York Metropolis passed the nation's strongest law restricting employment credit checks. While New York's law nevertheless contains a number of unjustified exemptions, these exclusions are narrower than in many other credit check laws, and New York'southward public outreach effort is exemplary.

To learn more almost the problems with employment credit checks that motivated many states laws, see Demos' report, Discredited: How Employment Credit Checks Keep Qualified Workers out of a Job.

Introduction

Over the concluding ten years, a growing number of cities and states passed laws limiting the apply of personal credit history in employment, also known every bit employment credit checks. Lawmakers are motivated by a number of well-founded concerns: although credit history is not relevant to employment, employment credit checks create barriers to opportunity and upward mobility, can exacerbate racial discrimination, and can lead to invasions of privacy. States laws to limit employer credit checks were enacted in California, Colorado, Connecticut, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington. Delaware has as well restricted the use of credit checks in hiring for public employment. Cities, including New York City and Chicago, accept restricted credit checks as well.1 In 2014 there were 39 state bills introduced or pending aimed at limiting the use of credit checks in employment decisions, as well as federal legislation proposed in the House and Senate.ii This report examines the bear upon of the credit check laws enacted and then far, considers barriers to their effectiveness and discusses strategies to increment protections for workers.

In researching this report, Demos conducted a search of legal databases Westlaw and Lexis Nexis for cases brought under each statute, queried enforcement officials in each state about complaints and enforcement deportment taken under the law, and contacted legislators for their impressions on the effectiveness of the legislation. We begin by looking more closely at the practice of employment credit checks and exploring the motivation for restrictions.

What Are Employment Credit Checks?

Credit checks are widely used by employers making hiring decisions.3 The federal Fair Credit Reporting Act (FCRA) also permits employers to request credit reports on existing employees for decisions on promoting or firing workers.4 While employers mostly cannot admission three-digit credit scores, they can obtain credit reports that include information on mortgage debt; data on student loans; amounts of car payments; details on credit card accounts including balances, credit limits, and monthly payments; bankruptcy records; bills, including medical debts, that are in collection; and tax liens. Nether the statute, employers must first obtain written permission from the individual whose credit study they seek to review. Employers are too required to notify individuals earlier they accept "agin activity" (in this instance, failing to rent, promote or retain an employee) based in whole or in part on any information in the credit written report. The employer is required to offer a copy of the credit written report and a written summary of the consumer's rights along with this notification. After providing job applicants with a short period of fourth dimension (typically three to 5 business days) to identify and begin disputing any errors in their credit report, employers may then have action based on the written report and must once more notify the job applicant.

Credit reports were adult to help lenders assess the risks associated with making a loan. Over the final few years, they have been aggressively marketed to employers as a means to gauge an applicant'southward moral character, reliability or likelihood to commit theft or fraud. While the practice of checking credit may announced benign, a growing body of research suggests that credit checks do not accurately measure employment-related characteristics and may instead bar many qualified workers from employment. A 2013 Demos written report found that 1 in ten unemployed workers in a low or middle-income household with credit card debt were denied a job considering of a credit check.5

Why Restrict Employment Credit Checks?

Credit checks bar qualified workers from jobs because poor credit is associated with unemployment, medical debt and lack of health coverage, which tell very little most personal job functioning, simply rather reveal systemic injustice, individual bad luck, and the impact of a weak economy.6 The financial crisis and the Great Recession caused millions of Americans to exist laid off from their jobs, see their domicile values plummet to less than their mortgage debt, and notice their savings and retirement accounts decimated – all of which tin touch on credit history. Fifty-fifty seven years after the initial stock market crash, wages for all but the top 95th income percentile have not recovered.seven Though job markets have recovered to some extent, the recovery has been slow and many Americans take been left behind.8 These are largely factors that are exterior an individual's control and have no reflection on someone's "moral character" or their ability to adequately perform their job. Rather, credit checks are unfair and discriminate against the long-term unemployed and other disadvantaged groups, creating a barrier to upwardly mobility.

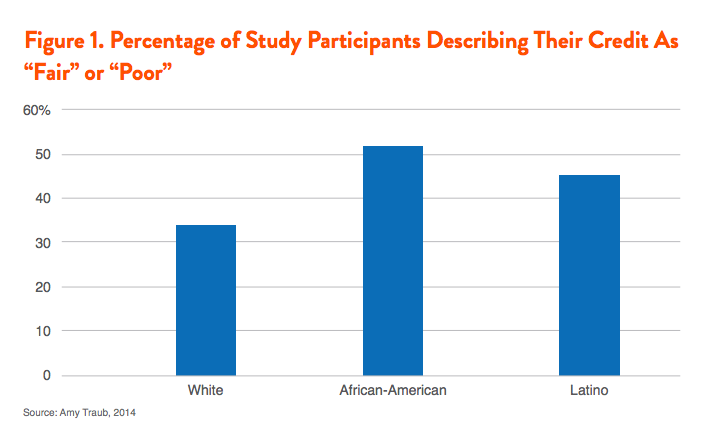

Considering of the legacy of predatory lending and racial bigotry, people of color tend to accept lower credit ratings than whites, and so may exist unduly likely to be denied a job considering of a credit check.9 A persistent legacy of discriminatory lending, hiring, and housing policies has left people of color with worse credit, on average, than white households.10 In recent years, historic disparities have been compounded by predatory lending schemes that targeted low-income communities and communities of color, putting them at greater run a risk of foreclosure and default on loans, further damaging their credit.11 By evaluating prospective employees based on credit, employment credit checks can farther extend this injustice.

Worryingly, credit reports are ofttimes riddled with errors. A Demos written report of low- and middle-income households conveying credit card debt finds that 1 in 8 respondents who have poor credit cite "errors in my credit written report" for their credit problems.12 A Federal Trade Commission (FTC) written report finds that 5 percentage of consumers, amounting to 45 million Americans, had errors on at to the lowest degree one of their three major credit reports.13 A follow-upward report finds that majorities of these consumers even so have outstanding errors on their credit report.xiv A 2011 industry-funded report by the Policy and Economic Inquiry Council (PERC), found that 1 in 5 people who reviewed their credit written report found incorrect data and 12.1 percent of those errors could have a material impact on their score.15 As a result of employment credit checks, individuals can be disqualified from job considering of a credit written report that is not even factual.sixteen As the New York Times editorial board noted, "the involvement around this outcome shows that more constabulary makers are starting to realize how this unfair practice amercement the lives and job prospects of millions of people."17

The invasion of privacy is some other business organization when personal credit data is used in employment. Non only do credit reports reveal a great bargain well-nigh an individual's personal fiscal history, they also provide a window into even more than securely individual matters such as medical history, divorce, and cases of domestic corruption. For example, surveys find that when a credit bank check is conducted, employers often ask individuals with flawed credit to explain why they are behind on their bills.18 Given that past due medical bills brand upwardly the majority of accounts reported by collection agencies, many prospective employees will experience obliged to hash out their otherwise confidential medical histories as a pre-requisite for obtaining employment. Since divorce and domestic abuse are other leading causes of credit struggles, a word of these frequently painful and deeply individual personal issues tin can also become compulsory if an task-seeker is asked to "explain" their poor credit to a prospective employer.

Strengths and Weaknesses of State Laws on Employment Credit Checks

Concerns nearly employment credit checks led to numerous land laws to limit them: California, Colorado, Connecticut, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington have all passed legislation. In 2014, Delaware passed a more express police force preventing public employers from using credit checks for employment decisions.19 Chicago has also passed a constabulary prohibiting credit checks from being used in employment decisions.20 More recently, New York City banned credit checks, and made an try to limit exemptions (see folio sixteen).21 There is evidence that in that location is broader interest, however, since thirty-9 bills in 19 states were introduced in 2014.22 In addition, legislation has been presented at the federal level, including a bill by Sen. Elizabeth Warren (in the Senate) and Rep. Steven Cohen (in the House).23 This report explores the effectiveness of the credit cheque laws, and finds that lack of articulate enforcement mechanism, exemptions and a robust public outreach effort have all undermined the effectiveness of credit cheque laws.

Credit Check Laws Lift Employment in Areas with Poor Credit

New enquiry by Robert Clifford at the Federal Reserve Bank of Boston and Daniel Shoag at Harvard University's Kennedy School suggests that credit bank check laws are effective at increasing employment among job applicants with poor credit.24 Drawing on credit agency and employment data, the authors find that state laws banning credit checks increase overall employment in low-credit census tracts by between 2.iii and 3.3 percent. Despite exemptions that enable employers to continue conducting credit checks for many job categories, the authors observe that credit cheque laws also led to a significant 7 to 11 percent reduction in employer use of credit checks.25 The largest impact on jobs was found in the public sector, followed by employment in transportation and warehousing, data, and in-home services.

The authors discover that equally the use of credit information in hiring declined, employers elevated other employment criteria, increasingly requiring college degrees or additional work experience. Given that these factors comprise more relevant data about task performance than credit checks, this is a step forward.26 However, inflating job requirements beyond what a given position genuinely demands may present its ain problems, erecting new and unnecessary barriers to employment. Inflating employment criteria may assist to explicate a troubling finding of the study: African-American workers feel slightly worse employment outcomes relative to white workers in states that accept restricted employment credit checks. The authors of the study have best-selling a number of uncontrolled variables (such as the over-representation of African Americans in public employment in states that have enacted employment credit check restrictions) may have skewed this result.27 Even so, information technology raises an of import warning: credit check laws by themselves cannot eliminate employment bigotry, and policymakers must remain warning for the resurgence of discriminatory practices.

Credit Bank check Laws Include Unjustified Exemptions

While country laws were ostensibly enacted to preclude employment credit checks from becoming an employment barriers for qualified workers, we find that these laws have been undermined past the numerous broad exemptions they contain. Currently, all state credit bank check laws include exemptions – job categories where credit checks continue to exist permitted even as the law bans credit checks for other positions. Considering these exemptions are often vague and cover large categories of workers, they have reduced the effectiveness of land laws. The well-nigh common exemptions are provisions that let for a credit check if information technology is "essentially task related" or the employer is a financial institution. Other laws contain exemptions permitting credit checks for management positions, police force enforcement jobs, or employees with admission to cash or appurtenances.

In an analysis of exemptions in state credit bank check laws, James Phillips and David Schein argue that states restricting employment credit checks "have virtually gutted those restrictions by exception."28 Legislators themselves take expressed business organisation well-nigh the meaning exemptions that were ultimately included in the laws. In Vermont, Helen Head, Chair of the Commission on General, Housing & Military machine Affairs tells Demos that, "We are concerned that the large number of exceptions may make it more than difficult to limit the practice of employer credit checks. In hindsight, I wish we had worked fifty-fifty harder than we did to limit the broad exclusions that were passed in the Vermont neb." Vermont Representative Kesha Ram echoed the sentiment, noting that, "we included a number of exemptions in terms of types of employment and that these may limit the effectiveness of the law." These exemptions both make information technology more difficult for employees to know whether they tin seek amercement, and also more difficult for courts to rule in their favor. Further, exemptions can hamper enforcement, by making it more risky for the authorities agency tasked with enforcement to determine whether in that location has been a violation.

While these exceptions announced to take deeply hampered the effectiveness of these laws, their merit is dubious. The department below examines these exemptions and shows why virtually are unjustified and unnecessary.

- Credit checks are not justified for employees handling cash or goods

A number of land laws include exemptions permitting credit checks for employees that handle cash or have admission to valuable property. These exemptions are based on the incorrect premise that a job applicant's personal credit study tin can predict whether someone is likely to steal. TransUnion, a major credit reporting company admitted in public testimony, "we don't take any research to evidence any statistical correlation between what'southward in somebody's credit report and their job operation or their likelihood to commit fraud."29 Every bit noted before in this report, poor credit scores reflect financial distress and racial disparities, not propensity to commit crimes.

- Credit checks are not justified for employees with access to fiscal information

The rationale for checking credit when hiring for positions with access to financial or other confidential data is the same every bit for employees who handle cash – a mistaken premise that poor credit can predict whether an employee will misuse information to steal or commit fraud. The credit reporting manufacture frequently cites the amount of money businesses lose to fraud annually to illustrate the seriousness of the problem.xxx Nevertheless, equally discussed to a higher place, at that place is little evidence that reviewing credit reports is an constructive tool to screen out fraud-decumbent employees.

- Credit checks are not justified for management positions

Permitting credit checks for direction or supervisory positions limits the advancement of people struggling to pay their bills, regardless of their qualifications. This is peculiarly troubling given racial disparities in credit quality and the lack of people of colour in managerial positions.31 Given the discriminatory touch on of employment credit checks, creating exemptions for management or supervisory positions could statutorily create two tiers of job opportunity depending on race and class. In effect, exemptions that permit credit checks for managerial or supervisory positions would keep people who are struggling to pay their bills stuck on the lesser rungs of the task ladder, no affair how skilled they may be. - Credit checks are non justified for police force enforcement positions

Despite a lack of evidence that reviewing personal credit history can reveal how responsible, honest, or reliable an applicant will be on the job, many police departments go along to conduct credit checks and reportedly disqualify candidates with poor credit.32 This is especially dangerous considering using a faulty screening tool such equally credit history may provide a faux sense of security to law enforcement agencies if they erroneously believe a credit cheque volition assist to prevent them from hiring dishonest officers vulnerable to abuse. In addition, racial disparities in credit quality mean that the utilise of employment credit checks may make it more hard for constabulary enforcement agencies to hire and promote a racially diverse police force or one that better reflects the jurisdiction it is policing. As law enforcement agencies across the country go on to face decades-one-time concerns almost sufficient opportunities for people of color to be hired and promoted within their ranks, the use of employment credit checks exacerbates this core civil rights business concern.

- Credit checks are not justified for employees of financial institutions

Like other exemptions, a carve-out allowing banks and other financial institutions to go along doing credit checks is based on the misconception that someone who has faced financial challenges in their own life will not be a practiced employee at a financial establishment. In fact, fiscal services is the merely specific manufacture to have been the subject of a rigorous academic study, which concluded that credit reports do no predict job performance in a financial services job.33 After analyzing employees holding jobs falling within a "financial services and collections" job category of a large financial services system, the study found that information in the credit reports of these employees had no relationship with employee performance or employee terminations for misconduct (or any other negative reason).

- Broad standards-based exceptions are entirely unjustified

The worst categories of exceptions are those that allow credit checks based on wide standards, such equally "relevance," "fiduciary duty" or "substantially job related." These exceptions are even less justified than exceptions for specific chore categories, because they are overly expansive and get out many workers unprotected from the unfairness of employment credit checks. Such exemptions are particularly prone to corruption, giving employers almost unlimited leeway to circumvent the law.

- To address concerns well-nigh federal preemption of country or local laws, an exemption permitting employment credit checks in cases where they are required by federal law is justified.

Federal law mandates that an employment credit check be performed in a narrow range of cases, for example when hiring a mortgage loan originator.34 To avert a conflict between country and federal police that could consequence in litigation and the preemption of land police, permitting employment credit checks when they are explicitly required by federal law is a legitimate exemption.

As Phillips and Schein note, "nigh every state has articulated specific job-related requirements that make clear when these exceptions are applicable and under what circumstances they volition provide an employer with legally sufficient grounds to brand a credit history check a requirement or condition of the employment." They farther note that, "exceptions to the ten state statutes have most swallowed those states' legal prohibitions [indicating] that under country police, an employer is virtually free to employ credit reports to make employment decisions."35

Credit Check Laws Go Largely Unenforced

States accept a range of enforcement mechanisms for laws restricting employment credit checks. Some states give enforcement authority to the Section of Labor/Labor Commission (Connecticut, Colorado, Maryland, Nevada, Oregon) others to the Chaser General (Washington), ane to the Department of Fair Employment and Housing (California), and ane to the Civil Rights Commissioner (Hawaii) and Vermont splits enforcement betwixt two agencies. In addition, Hawaii, Illinois, Nevada, Oregon and Vermont permit employees or jobseekers harmed past violations of the law to bring a private lawsuit against the violator. One significant shortcoming of many country enforcement efforts is that states are making fiddling investment in investigating employment and hiring practices to discover violations of the law. Instead, the burden is placed on employees and task-seekers who had their credit checked in violation of the police to file a complaint before whatsoever activity tin can be taken. Because potential employees may non know a violation has occurred, or fifty-fifty know that they are protected from employment credit checks, placing the brunt on employees makes it far more probable that these laws volition go unenforced.

Demos contacted state officials for insight on how these laws are being enforced.

- In Connecticut, Nancy Steffens, the Communications Director of the Department of Labor tells Demos that there have been no complaints constitute to be meritorious. In the 4 year catamenia since the law went into place, only two complaints had been filed with the Wage and Workplace standards partition.

- In Maryland, Geoff Garner, the Program Ambassador of the Worker Classification Protection Unit, tells Demos that "only two actual complaints since the law went into effect. Both complaints were investigated and resolved informally (without citations or fines)."

- Charlie Burr, the Communications Manager for the Oregon Bureau of Labor and Industries provided data on the eight cases that have been filed since the police force was passed in 2010, which he notes is, "important worker protection, but it's however relatively new." The information he sent include eight cases over a four twelvemonth menstruum, with two under investigation at the time of inquiry. Iii of the cases were airtight considering no substantial show of a violation was constitute. Another was settled privately, some other withdrawn from court and the final led to a negotiated conciliation.

- In Vermont, one official in the Civil Rights Section of the Attorney Full general tells Demos that credit checks are "non really on our radar" at the function mainly because the section doesn't have authority to inspect and thus must await for complaints. However, since just ane complaint was ever filed, and the adverse consequence stemmed from a criminal groundwork check, not an employment credit check, no enforcement resulted. Vermont tasked the Vermont Man Rights Committee with enforcing the credit check police for state employees. Even so, an official there tells Demos, "The HRC has not gotten any complaints almost credit reporting since the police was enacted."

- In Colorado, the Department of Labor is tasked with enforcing the employment credit bank check law. Elizabeth Funk, Labor Standards Administrator, tells Demos, "Since 2013, the Division has received several complaint forms. I would say approximately x - 20 complaints, and over 100 inquiries in the grade of email and phone calls." She reports that, "Of the approximately ten-xx complaints, I would say one-half accept led to an investigation conducted past our Segmentation. The police gives the Division discretion to assess a penalisation if an employer is constitute in violation of the constabulary. " As of notwithstanding, however, she notes that, "Nosotros are nonetheless in center of the investigations so no penalties have been levied at this fourth dimension."

- In Washington, enforcement falls under the state's Fair Credit Reporting Deed, which is enforced by the Attorney General. The Attorney General's Office declined to make data virtually the number of complaints received or actions taken available.

- In California, the section tasked with enforcement, the Department of Fair Employment and Housing, tells Demos that they don't accept a cardinal database of complaints, and therefore could non provide an estimate. Herbert Yarbrough, the Ambassador of the Department of Off-white Employment and Housing, said that he couldn't call back whatsoever instances. However, as was establish in Maryland and Vermont, complaints that were filed tended to be lumped in with other violations.

- In Hawaii, Pecker Hoshijo, the Executive Director of the Hawaii Civil Rights Commission, tells Demos that "a query of our database plant no complaints raising a claim of employment bigotry based on credit history or credit report from enactment in 2009 through the nowadays."

Hawaii, Illinois, Nevada, Oregon and Vermont allow employees or jobseekers harmed past violations of the law to bring a individual lawsuit against the violator. A search of Westlaw and Lexis Nexis returned no cases of individuals pursuing suits in these states.

Greater Public Sensation Would Increment Effectiveness

Since states depend on public complaints to initiate an investigation and enforcement of their employment credit check laws, public sensation of the laws amid employees and task seekers is critical to preventing the legislation from condign a dead letter. It is every bit essential that employers are enlightened of the law and empathise their responsibilities so that they tin can comply. Demos asked state agencies responsible for enforcing the laws about any public awareness or outreach efforts surrounding the laws. No state pursued an advertizement campaign (although come across page 16 for details most the New York Urban center law, which included a model outreach campaign). Yet some states pursued more outreach than others. It is notable that Colorado, which reported the greatest number of complaints nether the employment credit checks law, was as well among the states that reported a more vigorous public outreach effort to assist workers and employers sympathise rights and responsibilities nether the law.

- The Communications Director for the Oregon Bureau of Labor and Industries, reports that local newspapers had "initial coverage during the debate, a wave of coverage after its passage, and some other round later the law took issue." He cited four articles to this extent.36

- The Program Administrator of the Maryland Worker Classification Protection Unit tells Demos that in his state, "When a new law goes into event, we don't generally do outreach, but we endeavour to mail as much helpful information on our website as possible."

- Elizabeth Funk the Labor Standards Administrator for the Colorado Division of Labor tell Demos that, " Nosotros have a webpage on our Division of Labor website defended to this topic… On our webpage, we have a fact sheet available for individuals to download. We also accept oftentimes asked questions on this law. There is too a specific complaint form with accompanying instructions that explains the nuts of the law." She notes that in addition, "In an endeavour to get the give-and-take out, the agency'southward monthly and quarterly employer newsletter had articles and blurbs about this new law." Funk further notes efforts to inform employers of the constabulary. "Since the law passed, the Division has presented to several police force firms, employers, and bar associations. During those presentations, nosotros take explained this new law and the available resources the Partition has on our website."

- Bill Hoshijo, the Executive Director of the Hawaii Ceremonious Rights Commission tells Demos that, "At that place was initial outreach and education on the new law later Deed 1 was enacted in 2009." He included in his correspondence a re-create of the press release, equally well as a flier that was used for public outreach regarding recent developments. He notes that, "In 2010, we connected to include information on the credit history and credit report protection, including inserts on the new police force in all outreach efforts."

No other states could bespeak to specific media outreach.

A look at other types of employment legislation underscores the importance of broad public awareness. For example, a written report of New York City workers finds that employers oft shirk mutual labor protections like the minimum wage.37 One study of workers in Chicago, New York City and Los Angeles stunningly finds that 76 percentage of workers "were not paid the legally required overtime charge per unit."38 A report of Philadelphia's Restaurant Industry finds that 61.v pct of workers surveyed "did not know the correct legal minimum wage."39 Regarding illegal pay secrecy policies, Craig Becker, general counsel for the AFL-CIO tells The Atlantic that, "The problem isn't so much that the remedies are inadequate, only that and so few workers know their rights."40

Ending Credit Discrimination in New York City

New York City'southward Stop Credit Discrimination in Employment Act was signed into law by Mayor Bill de Blasio on May 6, 2015 and went into effect on September iii, 2015. The legislation, sponsored by City Council-member Brad Lander, amends the Urban center'due south Human Rights Law to make it an unlawful discriminatory practice for an employer to utilise an individual'due south consumer credit history in making employment decisions. While New York'due south constabulary is likewise new to exist evaluated for its effectiveness, the narrowness of the beak's exemptions, the robust public sensation entrada, and strong enforcement mechanisms make it the strongest restriction on employment credit checks enacted anywhere in the U.S. at the time of this report'southward publication. However, exemptions that were added to the law equally the upshot of political negotiations should non be considered a model for other jurisdictions.

- How the law was enacted: The Terminate Credit Discrimination in Employment Human action was the upshot of a multi-year campaign past a wide coalition of labor, community, student, legal services, civil rights, and consumer groups. The coalition organized New Yorkers impacted by employment credit checks to tell their stories, met with City Quango Members and other municipal officials, held rallies and press conferences, published op-eds, and distributed out fliers. Initially, the legislation independent a single exemption, permitting employment credit checks only in cases where the credit bank check was required by state or federal law in gild to avoid pre-emption challenges. Notwithstanding, opposition from the city's business lobby, constabulary enforcement officials, and other interests resulted in a number of exemptions that ultimately weakened the constabulary. Nonetheless New York Metropolis managed to avoid many of the broadest exemptions contained in the other land credit check laws discussed in this report.

- What's in the law: The Stop Credit Discrimination in Employment Act prohibits employers from requesting a credit check or inquiring about an employee or task seekers' credit history when making employment decisions for most positions. The police force contains exemptions for police officers and peace officers; executive-level jobs with control over finances, computer security, or trade secrets; jobs bailiwick to investigation by the city's Department of Investigation; and positions where bonding or security clearance is required past constabulary. These exemptions were the consequence of local political compromises and should not be considered a model for futurity legislation. As role of New York's Human Rights law, the employees and job seekers are protected from retaliation for making a charge.

- Potent enforcement mechanisms: If an employer requests a credit check in violation of the NYC law, employees and jobseekers have i yr to file a complaint with the city's Committee on Human Rights. Employers found to accept violated the law may be required to pay amercement to the employees affected and may be subject to ceremonious penalties of up to $125,000. A willful violation may exist subject to a civil penalty of upwardly to $250,000.

- A broad public awareness campaign: One distinguishing characteristic of New York's law is the public sensation campaign undertaken past the city, which included ads on subways and buses and on the encompass of the city'due south gratuitous newspapers alerting employees and employers about the new law; fliers about the law distributed at subway stations during the morning commute; and a social media campaign with a unique hashtag #CreditCheckLawNYC. The NYC Commission on Human Rights also set web pages clearly explaining the law and its parameters, offered a series of gratuitous "know your rights" trainings for employees/job seekers and "know your obligations" trainings for employers, and published brochures virtually the constabulary in the city'due south ten nigh spoken languages.

Policy Recommendations

Employment credit checks are a discriminatory barrier to employment. Our inquiry suggests that states motivated to curtail this practice can enact more effective legislation by:

- Fugitive unjustified exemptions: The exemptions in existing state laws are not substantiated by research or other evidence showing that credit checks are valid for the exempted positions. Indeed, no peer-reviewed studies find that a job applicant's personal credit study is a reliable indicator of the applicant's futurity performance on the job or likelihood of committing fraud or any other form of misconduct or crime. It makes sense for credit check laws to include an exemption that prevents state or local laws from conflicting with federal law and potentially triggering a preemption challenge, but no other exemption is empirically justified.

- Launching a public outreach endeavor: To ensure that workers know their rights and employers know the police, states should engage in extensive public outreach. Currently, media outreach primarily consists of a state website explaining the police force. Even the stronger efforts rely heavily on media coverage, which may not occur. Given the relative obscurity of credit check laws, vigorous efforts are required. The outreach endeavor undertaken past New York City's Commission on Human Rights should exist considered a model.

- Investigating compliance: Labor departments and other agencies tasked with enforcing the police force should have the ability to audit compliance, rather than only respond reactively to complaints. The right to pursue individual lawsuits, though it has been under-utilized to date, should remain a part of these laws.

- Articulate record keeping: In one land that Demos contacted, California, in that location was not a central database of complaints that could be used to decide how many complaints had been received. In another, Washington, data are but made available to the public via a complaint form that requires an individual to select a specific business organization. To ameliorate track the effects of legislation, states should maintain a database of complaints and enforcement actions.

Conclusion

The use of employment credit checks creates barriers to opportunity and upwardly mobility, exacerbates racial bigotry, and can lead to invasions of privacy. Yet because of unjustified exemptions in the laws, lack of public awareness, and a dearth of proactive enforcement, laws against credit checks have non been as effective equally they should be. Nevertheless, despite inconsistent coverage and enforcement, laws may have deterred credit checks. The number of employers reporting that they used credit checks when hiring for some or all positions savage from threescore percent in 2010 to 47 percent in 2012, co-ordinate to the Gild for Human Resources Direction.41 Both the laws, and the lack of evidence that credit checks are effective have been cited equally reasons for the decline.42 Enquiry suggests the laws reduced the apply of credit checks by between 7 and 11%.43 However, it is worrying that near a decade since the first law was passed, Demos has failed to observe bear witness that a single employer fined for using an illegal credit check on a prospective employee.

- 1State laws include: Wash. Rev. Code § 19.182.020 ; Ore. Rev. Stat. § 659A.320; 820 Ill. Comp. Stat. §§ 70/1 to seventy/30; Cal. Labor Code § 1024.5 et seq.; Conn. Pub. Act No. 11-223; Md. Lawmaking Ann., Labor & Empl. Law § 3-711; Haw. Rev. Stat. §§ 378-2.seven, 378-2(8); and Vermont Act No. 154.

- 2National Briefing on Country Legislatures, "Apply of Credit Information In Employment 2014 Legislation," May 6, 2015. Bachelor at: http://www.ncsl.org/research/fiscal-services-and-commerce/use-of-cred....

- 3The use of credit checks has been increasing, from 13% in 1996 to 60% in 2010, though at that place was a dip in 2012. Lea Krivinskas Shepard, "Toward a Stronger Financial History Antidiscrimination Norm," Boston College Law Review, 53: five, (2012). Available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2164633&download=yeah.

- 415 U.S.C. 1681(b)(3)(B).

- 5Amy Traub, "Discredited," 2013, Demos. Available at: http://www.demos.org/sites/default/files/publications/Discredited-Demos.pdf.

- 6Ibid.

- 7Elise Gould, "2014 Continues a 35-Year Trend of Wide-Based Wage Stagnation," February 2015, Economic Policy Institute, Available at: http://www.epi.org/publication/stagnant-wages-in-2014/.

- 8Bureau of Labor Statistics, "Labor Force Statistics from the Current Population Survey," Available at: http://www.bls.gov/spider web/empsit/cpsee_e16.htm.

- 9Amy Traub and Catherine Ruetschlin, "The Plastic Safety Net," May 22, 2012, Demos. Available at: http://world wide web.demos.org/publication/plastic-safety-internet.

- 10Board of Governors of the Federal Reserve System, "Report to the Congress on Credit Scoring and Its Effects on the Availability and Affordability of Credit," 2007; Federal Merchandise Commission, "Credit-BasedInsurance Scores: Impacts on Consumers of Auto Insurance," 2007; Robert B. Avery, Paul S. Calem,and Glenn B. Canner, "Credit Report Accuracy and Access to Credit," Federal Reserve Bulletin, 2004; MattFellowes, "Credit Scores, Reports, and Getting Ahead in America," Brooking Institution, 2006.

- 11Jacob Due south. Rugh and Douglas Southward. Massey, "Racial Segregation and the American Foreclosure Crunch" American Sociological Review, Volume 75 Number 5 October 2010; Andrew Jakabovics and Jef Chapman, "Unequal Opportunity Lenders? Analyzing Racial Disparities in Large Banks' Higher-Priced Lending," Center for American Progress, 2009. http://www.americanprogress.org/problems/housing/report/2009/09/fifteen/6704/ unequal-opportunity-lenders/

- 12"Discredited."

- 13Federal Trade Commission, "In FTC Report, V Per centum of Consumers Had Errors on Their Credit Reports That Could Event in Less Favorable Terms for Loans," February 11, 2013. Available at: https://www.ftc.gov/news-events/press-releases/2013/02/ftc-written report-five-pe...

- 14Federal Merchandise Commission, "FTC Issues Follow-Up Study on Credit Study Accurateness," Jan 21, 2015, Available at: https://www.ftc.gov/news-events/press-releases/2015/01/ftc-issues-follow....

- 15Amy Traub, "Credit Reports and Employment: Findings from the 2012 National Survey on Credit Card Debt of Depression- and Middle-Income Households," Suffolk Academy Law Review, Vol. XLVI:983-995. Available at: http://suffolklawreview.org/wp-content/uploads/2014/01/Traub_Lead.pdf.

- 16Daniel J. Solove, "Privacy and Ability: Computer Databases and Metaphors for Information Privacy," Stanford Law Review, Vol. 53:1393-1462. Bachelor at: http://scholarship.police force.gwu.edu/cgi/viewcontent.cgi?article=2077&context=...

- 17New York Times Editorial Lath, "The Credit History Underclass," May 30, 2012, New York Times. Available at: http://www.nytimes.com/2012/05/31/stance/the-credit-history-underclass.....

- 18Society for Homo Resource Management, "Background Checking: The Implications of Credit Groundwork Checks on Hiring Decisions," August 24, 2010.

- 19Use of Credit Information In Employment 2014 Legislation, Footnote ii

- 20City of Chicago, "City Council Approves Police Prohibiting Discrimination Based on Credit History," March fourteen, 2012. Available at: http://www.cityofchicago.org/city/en/depts/cchr/supp_info/city_council_a....

- 21Amy Traub, "The Progressive Victory You Haven't Heard Of: NYC's Ban on Employment Credit Checks," July nine, 2015 The American Prospect. Available at: http://prospect.org/commodity/progressive-victory-you-havent-heard-nycs-ba....

- 22Use of Credit Data In Employment 2014 Legislation, Footnote 2

- 23United States Senate: Southward.1837-Equal Employment for All Deed of 2013. https://beta.congress.gov/bill/113th- congress/senate-bill/1837.

- 24Robert Clifford and Daniel Shoag, "'No More Credit Score' Employer Credit Bank check Bans and Signal Substitution," (2015). Available at: http://scholar.harvard.edu/files/shoag/files/no_more_credit_score_employ...

- 25Ibid.

- 26Andrew Weaver, "Is Credit Condition a Good Indicate of Productivity?," ILR Review (May 2015). Bachelor at: http://ilr.sagepub.com/content/early/2015/05/16/0019793915586382.

- 27Robert Hiltonsmith conversation with Daniel Shoag, December 2015.

- 28http://rjolpi.richmond.edu/archive/PhillipsSchein_Formated.pdf

- 29Demos, "Memorandum on New York Urban center Employment Credit Checks," September 2014. Available at: http://www.demos.org/publication/memorandum-new-york-city-employment-cre....

- 30Tony Driessen, "Wisconsin AB 367 regarding the utilize of credit histories for employment purposes," August 2009. Available at: http://www.wisciviljusticecouncil.org/wwcms/wp-content/uploads/2009/08/0... Eric J. Ellman, "Re: Oppose H.B. 4528," March 2010, https://legislature.mi.gov/documents/2009-2010/CommitteeDocuments/House/....

- 31U.S. Equal Employment Opportunity Commission, "American Experiences Versus American Expectations," July 2015. Bachelor at: http://world wide web.eeoc.gov/eeoc/statistics/reports/american_experiences/.

- 32For instance, see Robin Pyle, "Bad credit could hurt your chances of condign a police ofcer," Lubbock Avalanche-Journal, September 26, 2010. http://lubbockonline.com/local-news/2010-09-26/bad-creditcould-injure-your...

- 33Laura Koppes Bryan and Jerry K. Palmer, "Do JobApplicant Credit Histories Predict Performance Appraisement Ratings or Termination Decisions?" The Psychologist-Manager Journal, 2012.

- 34http://world wide web.consumerfinance.gov/regulations/loan-originator-compensation-...

- 35Utilizing Credit Reports For Employment Purposes: A Legal Bait and Switch Tactic?, Footnote 20.

- 36Jessica Van Berkel, "New police prohibits credit history checks by most employers," June thirty, 2010, The Oregonian. Bachelor at: http://world wide web.oregonlive.com/politics/index.ssf/2010/06/new_law_prohibits_c... Daily Kos, "Oregon Bans Credit Checks past Employers," July 2010, bachelor at: http://www.dailykos.com/story/2010/07/01/880824/-Oregon-Bans-Credit-Chec... Melica Johnson, "Lawmakers: Credit history shouldn't keep you lot from a job," February 4, 2010, KATU, available at: http://www.katu.com/news/local/83524597.html; Michael Porter and Kathryn Fifty. Kammer, "BOLI issues Credit Check ban regulations," May 13, 2010, Oregon Business concern Report. Available at: http://oregonbusinessreport.com/2010/05/boli-issues-credit-bank check-ban-reg....

- 37Annette Bernhardt, Diana Polson and James DeFilippis, "Working Without Laws," 2015, National Employment Police force Projection. Bachelor at: http://www.nelp.org/content/uploads/2015/03/WorkingWithoutLawsNYC.pdf.

- 38Annette Bernhardt, Ruth Milkman, Nik Theodore, Douglas Heckathorn, Mirabai Auer, James DeFilippis, Ana Luz González, Victor Narro, Jason Perelshteyn, Diana Polson, Michael Spiller, "Cleaved Laws, Unprotected Workers," 2009, National Employment Law Projection. Available at: http://www.nelp.org/content/uploads/2015/03/BrokenLawsReport2009.pdf?noc....

- 39Center for Social Justice, "Shortchanged," Available at: http://www2.law.temple.edu/csj/files/wagetheft-report.pdf.

- 40Jonathan Timm, "When the Boss Says, 'Don't Tell Your Coworkers How Much You Get Paid'," July 15, 2014, The Atlantic. Bachelor at: http://www.theatlantic.com/business/annal/2014/07/when-the-dominate-says-d....

- 41Society for Human Resources Management, "Background checking–The Utilise of Credit Background Checks in Hiring Decisions" 2012. http://www.shrm.org/inquiry/surveyfindings/manufactures/pages/creditbackgro...

- 42Gary Rivlin, "The Long Shadow of Bad Credit in a Chore Search," May 11, 2013, New York Times. Available at: http://www.nytimes.com/2013/05/12/business/employers-pull-applicants-cre....

- 43See, Footnote 24

Source: https://www.demos.org/research/bad-credit-shouldnt-block-employment-how-make-state-bans-employment-credit-checks-more

0 Response to "Uploading Credit Report to Department of Labor Maryland"

Post a Comment